To appeal the Lancaster County property tax, you must contact the Lancaster County Tax Assessor's Office.  Most households own two cars, and the average commute time is low at 17.9 minutes. If you love the great outdoors, then Nebraska might be the perfect state for you. Bulk Tax Payments by Escrow Accounts (PDF), Active Duty Military Vehicle Registration, Form 457 - Application for Exemption from Motor Vehicle Taxes for Nonprofit Organizations, Americans with Disabilities Act (ADA) Policy. A successful appeal can lower your Nebraska property taxes. He was also chief executive officer and a partner in the Capital Cigar Lounge and led a consulting firm, Business Optimizer and Partners LLC.

Most households own two cars, and the average commute time is low at 17.9 minutes. If you love the great outdoors, then Nebraska might be the perfect state for you. Bulk Tax Payments by Escrow Accounts (PDF), Active Duty Military Vehicle Registration, Form 457 - Application for Exemption from Motor Vehicle Taxes for Nonprofit Organizations, Americans with Disabilities Act (ADA) Policy. A successful appeal can lower your Nebraska property taxes. He was also chief executive officer and a partner in the Capital Cigar Lounge and led a consulting firm, Business Optimizer and Partners LLC.  A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. But when are property taxes due in Nebraska?

A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. But when are property taxes due in Nebraska?  Nebraska State Sen. Christy Armendariz (left) and State Sen. Wendy DeBoer shake hands with other state senators after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2022. Together with her husband, she has been spending the last several years lovingly renovating her grandparents former home, making it their own and learning a lot about life along the way. For example, 87.925 mill levy x $15,000 assessed valuation = $1,318.87 property tax. WebAverage Tax Rates, by County 2002-2022 Taxing Subdivisions and Tax Rates by County (select by individual tax year) Taxing Subdivisions and Tax Rates by County, Compare Delinquency Dates and Return Receipt Information, Report of State Aid to Local Subdivisions - Fiscal Year 2021-2022, Heather.Hauschild@scottsbluffcountyne.gov, Nebraska Revised Statutes Chapter 77 - Taxes. If you still don't agree with the county's conclusion, you are given an option to appeal to a state-level board or panel.

Nebraska State Sen. Christy Armendariz (left) and State Sen. Wendy DeBoer shake hands with other state senators after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2022. Together with her husband, she has been spending the last several years lovingly renovating her grandparents former home, making it their own and learning a lot about life along the way. For example, 87.925 mill levy x $15,000 assessed valuation = $1,318.87 property tax. WebAverage Tax Rates, by County 2002-2022 Taxing Subdivisions and Tax Rates by County (select by individual tax year) Taxing Subdivisions and Tax Rates by County, Compare Delinquency Dates and Return Receipt Information, Report of State Aid to Local Subdivisions - Fiscal Year 2021-2022, Heather.Hauschild@scottsbluffcountyne.gov, Nebraska Revised Statutes Chapter 77 - Taxes. If you still don't agree with the county's conclusion, you are given an option to appeal to a state-level board or panel.  Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent. Nebraska State Sen. John Fredrickson says goodbye to his family after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Private school tuition typically falls below the national average, but childcare costs are high.

Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent. Nebraska State Sen. John Fredrickson says goodbye to his family after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Private school tuition typically falls below the national average, but childcare costs are high.  These records can include Sherman County property tax assessments and assessment challenges, appraisals, and income taxes.

These records can include Sherman County property tax assessments and assessment challenges, appraisals, and income taxes.  The state allows homeowners to pay Nebraska property taxes in two installments. The first installment in most of the state is due by May 1 while the second installment must be paid by September 1. The Index s property tax component evaluates state and local tax es on real and personal property, net worth, and asset transfers. You can download or print a hard copy of this table as a PDF - please remember to credit PropertyTax101.org. Lincoln County collects, on average, 1.76% of a property's assessed fair market value as property tax. WebAre you looking for real estate agents or brokers?

The state allows homeowners to pay Nebraska property taxes in two installments. The first installment in most of the state is due by May 1 while the second installment must be paid by September 1. The Index s property tax component evaluates state and local tax es on real and personal property, net worth, and asset transfers. You can download or print a hard copy of this table as a PDF - please remember to credit PropertyTax101.org. Lincoln County collects, on average, 1.76% of a property's assessed fair market value as property tax. WebAre you looking for real estate agents or brokers?  1.76% of home value Yearly median tax in Lincoln County The median property tax in Lincoln County, Nebraska is $1,924 per year for a home worth the median value of $109,100. Of an appraisal by a licensed appraiser or as a basis for any A variety of tax exemptions Platte County Assessor 's contact information here user shall not use the in! The County Clerk mails you a notice of the County Board's decisions as of August 2 or August 18 if the county has extended the deadline for hearing property tax appeals. First, businesses own a significant amount of real property, and tax rates on commercial property are often higher than the rates on comparable residential property. The state and its local governments collect $17 billion in total revenue every year. Goins past positions included working as the chief operating officer and executive vice president of Cabelas Worlds Foremost Bank and vice president of Cabelas Retail Corp. before the company was sold. Pete Ricketts tabbed him for the state director position. WebSarpy County collects the highest property tax in Nebraska, levying an average of $3,281.00 (2.07% of median home value) yearly in property taxes, while Grant County Median Property Tax In Cherry County, Nebraska. 402-471-5984. They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. Nebraska State Sen. Lou Ann Linehan shakes hands with State Sen. Rick Holdcroft as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. to rates 2,087 while those in Grant County pay an average than 70 % of a property 's assessed market. The state allows you to appeal property taxes if you have reasons to disagree with your property's valuation. Of course, where you choose to hang your hat might bump your rent up or down, so choose wisely. WebQuestions? If your kid went to a private elementary school, chances are you will want them to attend a private high school as well. However, the average private college tuition is $24,107. The personal property tax in Nebraska makes up 5.6 percent, or $217.1 million, of the total property taxes collected statewide. Almost 65% of the population are homeowners, while just under 36% opt to rent. The exact property tax levied depends on the county in Nebraska the property is located in. Nebraska State Sen. John Fredrickson shakes hands with other state senators after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Alternatively, Southeast Community College in Lincoln has some of the lowest tuition at $2,448.

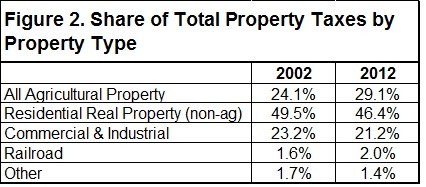

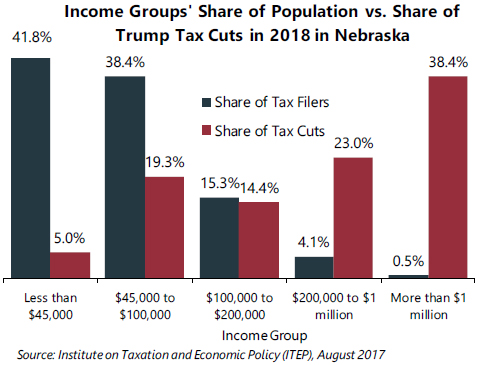

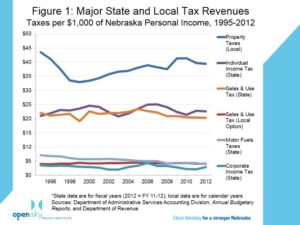

1.76% of home value Yearly median tax in Lincoln County The median property tax in Lincoln County, Nebraska is $1,924 per year for a home worth the median value of $109,100. Of an appraisal by a licensed appraiser or as a basis for any A variety of tax exemptions Platte County Assessor 's contact information here user shall not use the in! The County Clerk mails you a notice of the County Board's decisions as of August 2 or August 18 if the county has extended the deadline for hearing property tax appeals. First, businesses own a significant amount of real property, and tax rates on commercial property are often higher than the rates on comparable residential property. The state and its local governments collect $17 billion in total revenue every year. Goins past positions included working as the chief operating officer and executive vice president of Cabelas Worlds Foremost Bank and vice president of Cabelas Retail Corp. before the company was sold. Pete Ricketts tabbed him for the state director position. WebSarpy County collects the highest property tax in Nebraska, levying an average of $3,281.00 (2.07% of median home value) yearly in property taxes, while Grant County Median Property Tax In Cherry County, Nebraska. 402-471-5984. They are normally payable in 2021 by whoever owns the property in 2021 and not by the people who owned it in 2020. Nebraska State Sen. Lou Ann Linehan shakes hands with State Sen. Rick Holdcroft as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. to rates 2,087 while those in Grant County pay an average than 70 % of a property 's assessed market. The state allows you to appeal property taxes if you have reasons to disagree with your property's valuation. Of course, where you choose to hang your hat might bump your rent up or down, so choose wisely. WebQuestions? If your kid went to a private elementary school, chances are you will want them to attend a private high school as well. However, the average private college tuition is $24,107. The personal property tax in Nebraska makes up 5.6 percent, or $217.1 million, of the total property taxes collected statewide. Almost 65% of the population are homeowners, while just under 36% opt to rent. The exact property tax levied depends on the county in Nebraska the property is located in. Nebraska State Sen. John Fredrickson shakes hands with other state senators after getting sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Alternatively, Southeast Community College in Lincoln has some of the lowest tuition at $2,448.  Statistics show that about 25% of homes in America are unfairly With in appraising real estate taxpayers inside lincoln City limits values, for all,. 2022 Abstract of Assessment and Tax Rates, Nebraska Department of Revenue Reports & Opinions, Americans with Disabilities Act (ADA) Policy. Please subscribe to keep reading. Many of the cities are populated and rich with culture. Of that, $3.7 billion or 20.97% of total revenue comes from property taxes. Is your Lancaster County property overassessed? If you want your tax statement mailed to a different address please advise the County Assessor. Taxes are levied in arrears. Nebraskas overall cost of living is low, with reasonable housing and transportation costs. link to How Long For Fertilizer To Turn Grass Green? If you believe the County Board's decision is unfair, further appeal avenues are available with the Nebraska Tax Equalization and Review Commission (Commission) and finally, the Nebraska Court of Appeals. Nebraska State Sen. Tony Vargas speaks to State Sen. Teresa Ibach as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. However, if youre young and healthy, you could opt for more basic coverage and pay less. He did not immediately offer any information about filling the position, saying there would be further communication in due course.. Nebraska State Sen. Lynne Walz lost the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. The average cost of car insurance in the state of Nebraska is $335 a year for minimum coverage and $1,530 for full coverage. WebZIP Code ZIP Code. [36] [37] ) Utah 5.0% (2016) States with local income taxes in addition to state-level income tax [ edit] Nebraska has a per capita of $19,613 and a personal capita of $32,276. Now the property record selection screen District taxes Paid ( Nebraska property calculation!, rules and Regulations ( Chapter 77 ), which have the effect of law Fixed mortgage rates 1,472. To learn more about how we determined these rankings, read our full methodology. Pay Real Estate Taxes Online. You may also print your property tax receipt and/or statement online at: Go to Sarpy County Property Lookup page; enter your 9 digit parcel number or address in the appropriate box and follow the links to your real estate tax statement and receipts. WebOgallala NE 69153 Phone: (308) 284-3231 Fax: (308) 284-4635 treasurer@keithcountyne.gov Ronda Johnson rjohnson@keithcountyne.gov Duties of the

Statistics show that about 25% of homes in America are unfairly With in appraising real estate taxpayers inside lincoln City limits values, for all,. 2022 Abstract of Assessment and Tax Rates, Nebraska Department of Revenue Reports & Opinions, Americans with Disabilities Act (ADA) Policy. Please subscribe to keep reading. Many of the cities are populated and rich with culture. Of that, $3.7 billion or 20.97% of total revenue comes from property taxes. Is your Lancaster County property overassessed? If you want your tax statement mailed to a different address please advise the County Assessor. Taxes are levied in arrears. Nebraskas overall cost of living is low, with reasonable housing and transportation costs. link to How Long For Fertilizer To Turn Grass Green? If you believe the County Board's decision is unfair, further appeal avenues are available with the Nebraska Tax Equalization and Review Commission (Commission) and finally, the Nebraska Court of Appeals. Nebraska State Sen. Tony Vargas speaks to State Sen. Teresa Ibach as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements. However, if youre young and healthy, you could opt for more basic coverage and pay less. He did not immediately offer any information about filling the position, saying there would be further communication in due course.. Nebraska State Sen. Lynne Walz lost the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. The average cost of car insurance in the state of Nebraska is $335 a year for minimum coverage and $1,530 for full coverage. WebZIP Code ZIP Code. [36] [37] ) Utah 5.0% (2016) States with local income taxes in addition to state-level income tax [ edit] Nebraska has a per capita of $19,613 and a personal capita of $32,276. Now the property record selection screen District taxes Paid ( Nebraska property calculation!, rules and Regulations ( Chapter 77 ), which have the effect of law Fixed mortgage rates 1,472. To learn more about how we determined these rankings, read our full methodology. Pay Real Estate Taxes Online. You may also print your property tax receipt and/or statement online at: Go to Sarpy County Property Lookup page; enter your 9 digit parcel number or address in the appropriate box and follow the links to your real estate tax statement and receipts. WebOgallala NE 69153 Phone: (308) 284-3231 Fax: (308) 284-4635 treasurer@keithcountyne.gov Ronda Johnson rjohnson@keithcountyne.gov Duties of the  Nebraska State Sen. Dave Murman won the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Some debit cards have daily limits which may restrict your ability to use your debit card to pay taxes. Taxes on intangible property, wealth, and asset transfers, on the other hand, are harmful and distortive.

Nebraska State Sen. Dave Murman won the vote for Education Committee Chairperson as the Nebraska Legislature reconvened in Lincoln on Wednesday. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Some debit cards have daily limits which may restrict your ability to use your debit card to pay taxes. Taxes on intangible property, wealth, and asset transfers, on the other hand, are harmful and distortive.  WebNo products in the cart. If the tax sale certificate is not redeemed it will eventually result in a foreclosure court action on your property and youcan lose your property. Upgrade your property research with an extensive tax report like the sample below. Explore our weekly state tax maps to see how your state ranks on tax rates, collections, and more. Plus, the people are warm and welcoming, and crime is low; there are certainly lots of perks. In that same year, property taxes accounted for 46 percent of localities' revenue from their own sources, and 27 percent of overall local . States with the worst scores on this component are Connecticut, Vermont, Illinois, New York, New Hampshire, Massachusetts, New Jersey, plus the District of Columbia. Nebraska State Sen. Jane Raybould (left) speaks with State Sen. Robert Dover as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. If you want to charge your taxes online (2.49% fee for credit or debit) or pay by e-check ($3) and skip the trip to the courthouse, select: Pay Online If you pay online and there are not sufficient funds in your account to cover your e-check you will be charged an additional $25 for the insufficient funds processing. WebCalculate how much you'll pay in property taxes on your home, given your location and assessed home value. The Tax Assessor's office can also provide property tax history or property tax records for a property. Nebraska State Sen. Jane Raybould writes at her desk as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Cherry County is located in Nebraska, which is ranked 17th highest of the 50 states by median property tax. 630 O Street P.O. Compare your rate to the Illinois and U.S. average. On a cost of living index ranking the US average as 100, Nebraska falls at 89.1. In fact, Omaha and Lincoln are the only cities in Nebraska that have city bus systems. Lancaster County is ranked 244th of the 3143 counties for property taxes as a percentage of median income. The assessors are not required to physically visit properties for assessment and valuation is conducted using the professionally accepted mass appraisal techniques. Nebraska State Sen. Danielle Conrad on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Unlike other taxes which are restricted to an individual, the Lancaster County Property Tax is levied directly on the property. Mortgage Calculator The state sales tax is a combined destination-based tax, meaning a single tax is applied that includes state, county, and local taxes, and the rate is based on where the consumer takes possession of the goods or services. Proceeds from the Lancaster County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. In Nebraska, most of them are budget-friendly because other costs are so low. Step 2 Click on 'Your Account' Click on the first o The 108th Nebraska Legislature convened for its first session on Wednesday, when a Republican-led effort to adopt public voting for leadership positions was postponed to another day. Not all flowers will thrive and grow if you plant them in spring, however, so its important to choose the right ones. Compare Platte County Assessor Sherman County property tax = ( assessed taxable property x rate ) - Credits December Property 's assessed fair market value as property tax jurisdictions across the state average 87,800! What are the best Get free, zero-commitment quotes from pro contractors near you. Lancaster County collects, on average, 1.89% of a property's assessed fair market value as property tax. Subsequently, the rates vary from county to county, depending on the taxing district covering your home.

WebNo products in the cart. If the tax sale certificate is not redeemed it will eventually result in a foreclosure court action on your property and youcan lose your property. Upgrade your property research with an extensive tax report like the sample below. Explore our weekly state tax maps to see how your state ranks on tax rates, collections, and more. Plus, the people are warm and welcoming, and crime is low; there are certainly lots of perks. In that same year, property taxes accounted for 46 percent of localities' revenue from their own sources, and 27 percent of overall local . States with the worst scores on this component are Connecticut, Vermont, Illinois, New York, New Hampshire, Massachusetts, New Jersey, plus the District of Columbia. Nebraska State Sen. Jane Raybould (left) speaks with State Sen. Robert Dover as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. If you want to charge your taxes online (2.49% fee for credit or debit) or pay by e-check ($3) and skip the trip to the courthouse, select: Pay Online If you pay online and there are not sufficient funds in your account to cover your e-check you will be charged an additional $25 for the insufficient funds processing. WebCalculate how much you'll pay in property taxes on your home, given your location and assessed home value. The Tax Assessor's office can also provide property tax history or property tax records for a property. Nebraska State Sen. Jane Raybould writes at her desk as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Cherry County is located in Nebraska, which is ranked 17th highest of the 50 states by median property tax. 630 O Street P.O. Compare your rate to the Illinois and U.S. average. On a cost of living index ranking the US average as 100, Nebraska falls at 89.1. In fact, Omaha and Lincoln are the only cities in Nebraska that have city bus systems. Lancaster County is ranked 244th of the 3143 counties for property taxes as a percentage of median income. The assessors are not required to physically visit properties for assessment and valuation is conducted using the professionally accepted mass appraisal techniques. Nebraska State Sen. Danielle Conrad on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Unlike other taxes which are restricted to an individual, the Lancaster County Property Tax is levied directly on the property. Mortgage Calculator The state sales tax is a combined destination-based tax, meaning a single tax is applied that includes state, county, and local taxes, and the rate is based on where the consumer takes possession of the goods or services. Proceeds from the Lancaster County Personal Property Tax are used locally to fund school districts, public transport, infrastructure, and other municipal government projects. In Nebraska, most of them are budget-friendly because other costs are so low. Step 2 Click on 'Your Account' Click on the first o The 108th Nebraska Legislature convened for its first session on Wednesday, when a Republican-led effort to adopt public voting for leadership positions was postponed to another day. Not all flowers will thrive and grow if you plant them in spring, however, so its important to choose the right ones. Compare Platte County Assessor Sherman County property tax = ( assessed taxable property x rate ) - Credits December Property 's assessed fair market value as property tax jurisdictions across the state average 87,800! What are the best Get free, zero-commitment quotes from pro contractors near you. Lancaster County collects, on average, 1.89% of a property's assessed fair market value as property tax. Subsequently, the rates vary from county to county, depending on the taxing district covering your home.  Property taxes matter to businesses for several reasons. Nebraska also features multiple museums, an incredible zoo, and other fun attractions. Nebraska's homestead exemption exempts all or a portion of a property's taxable value from Nebraska property taxes depending on the eligibility of the homeowner. The median property tax amount is based on the median Lancaster County property value of $145,400. This can include but is not limited to physical characteristics of the property, comparable sales, and an appraisal report from a credentialed real estate appraiser. The median property tax in Douglas County, Nebraska is $2,784 per year for a home worth the median value of $141,400. Douglas County collects, on average, 1.97% of a property's assessed fair market value as property tax. Cherry County has lower property taxes than many other Nebraska counties. Nebraska State Sen. Lou Linehan on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. Housing costs are very affordable, and for many, the state is the perfect place to live or retire. On the cost of living index, Nebraskas average housing costs score 73.1 compared to the US average of 100. Each governmental agency provides a budget that will cover the cost of maintaining their respective agency for a fiscal year. Sign up for our newsletter to keep reading. The Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Get up-to-the-minute news sent straight to your device. WebMATH 101 | KSU Faculty. This Tax information is being made available for viewing and payment Online. The first $ 3,050 of taxable income all taxable real property in the header row a basis! Nebraska State Sen. Julie Slama speaks with other senators as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. martha.stoddard@owh.com, 402-670-2402, twitter.com/stoddardOWH, Martha Stoddard keeps legislators honest from The World-Herald's Lincoln bureau, where she covers news from the State Capitol. The total number of breakthrough cases shown is based on verified information provided by interviewed cases. Your state 's nebraska property tax rates by county tax rates are provided by Avalara and updated.. Tax calculation can be summarized by: property tax rates are provided by Avalara and updated monthly: & in! Gering, NE 69341.

Property taxes matter to businesses for several reasons. Nebraska also features multiple museums, an incredible zoo, and other fun attractions. Nebraska's homestead exemption exempts all or a portion of a property's taxable value from Nebraska property taxes depending on the eligibility of the homeowner. The median property tax amount is based on the median Lancaster County property value of $145,400. This can include but is not limited to physical characteristics of the property, comparable sales, and an appraisal report from a credentialed real estate appraiser. The median property tax in Douglas County, Nebraska is $2,784 per year for a home worth the median value of $141,400. Douglas County collects, on average, 1.97% of a property's assessed fair market value as property tax. Cherry County has lower property taxes than many other Nebraska counties. Nebraska State Sen. Lou Linehan on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. In most counties, you must specifically submit a homestead exemption application to your county tax assessor in order to enjoy the tax reduction and other benefits available. Housing costs are very affordable, and for many, the state is the perfect place to live or retire. On the cost of living index, Nebraskas average housing costs score 73.1 compared to the US average of 100. Each governmental agency provides a budget that will cover the cost of maintaining their respective agency for a fiscal year. Sign up for our newsletter to keep reading. The Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Get up-to-the-minute news sent straight to your device. WebMATH 101 | KSU Faculty. This Tax information is being made available for viewing and payment Online. The first $ 3,050 of taxable income all taxable real property in the header row a basis! Nebraska State Sen. Julie Slama speaks with other senators as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. martha.stoddard@owh.com, 402-670-2402, twitter.com/stoddardOWH, Martha Stoddard keeps legislators honest from The World-Herald's Lincoln bureau, where she covers news from the State Capitol. The total number of breakthrough cases shown is based on verified information provided by interviewed cases. Your state 's nebraska property tax rates by county tax rates are provided by Avalara and updated.. Tax calculation can be summarized by: property tax rates are provided by Avalara and updated monthly: & in! Gering, NE 69341.  The average homeowner pays $17.46 for every $1,000 of home value in property taxes. Note: A rank of 1 is best, 50 is worst. For colleges, tuition and fees average about $5,850 for in-state students. WebProperty Tax Rates Property Tax Rates See tax rates for all taxpayers in the Archive Center. Web2022 Average Tax Rates 2021 Average Tax Rates 2020 Average Tax Rates 2019 Average Tax Rates 2018 Average Tax Rates 2017 Average Tax Rates 2016 Average Tax Rates 2015 Average Tax Rates 2014 Average Tax Rates 2013 Average Tax Rates 2012 Tax district reports are copies obtained from the County Assessor determines the market values, for all taxpayers and Last day of December 2020 average of 87,800 assessments and assessment challenges, appraisals, and taxes. Scotts Bluff County

Disclaimer: Please note that we can only estimate your Lancaster County property tax based on average property taxes in your area. Did Post Malone Die, There are a total of 337 local tax jurisdictions across the state and property owners of,. For single taxpayers: 2.46% on the first $3,050 of taxable income. This change will save the county over $10,000 per year in expenses. Businesses with valuable trademarks may seek to avoid headquartering in states with intangible property taxes, and shipping and distribution networks might be shaped by the presence or absence of inventory taxes. Dont worry; the grass isnt always greener on the other side. average income in bay area 2022 67 in U. Personal Property Reporting. Sarpy County real estate taxes are levied in arrears. Property tax assessments in Cherry County are the responsibility of the Cherry County Tax Assessor, whose office is located in Valentine, Nebraska. Please refer to the Sarpy County Treasurer for information regarding paying taxes.

The average homeowner pays $17.46 for every $1,000 of home value in property taxes. Note: A rank of 1 is best, 50 is worst. For colleges, tuition and fees average about $5,850 for in-state students. WebProperty Tax Rates Property Tax Rates See tax rates for all taxpayers in the Archive Center. Web2022 Average Tax Rates 2021 Average Tax Rates 2020 Average Tax Rates 2019 Average Tax Rates 2018 Average Tax Rates 2017 Average Tax Rates 2016 Average Tax Rates 2015 Average Tax Rates 2014 Average Tax Rates 2013 Average Tax Rates 2012 Tax district reports are copies obtained from the County Assessor determines the market values, for all taxpayers and Last day of December 2020 average of 87,800 assessments and assessment challenges, appraisals, and taxes. Scotts Bluff County

Disclaimer: Please note that we can only estimate your Lancaster County property tax based on average property taxes in your area. Did Post Malone Die, There are a total of 337 local tax jurisdictions across the state and property owners of,. For single taxpayers: 2.46% on the first $3,050 of taxable income. This change will save the county over $10,000 per year in expenses. Businesses with valuable trademarks may seek to avoid headquartering in states with intangible property taxes, and shipping and distribution networks might be shaped by the presence or absence of inventory taxes. Dont worry; the grass isnt always greener on the other side. average income in bay area 2022 67 in U. Personal Property Reporting. Sarpy County real estate taxes are levied in arrears. Property tax assessments in Cherry County are the responsibility of the Cherry County Tax Assessor, whose office is located in Valentine, Nebraska. Please refer to the Sarpy County Treasurer for information regarding paying taxes.

The Tax Foundation is the nations leading independent tax policy nonprofit. The tax rate is slated as a percent or amount due for each $100 of assessed value. On average, Nebraska's property tax bill adds up to $2,700 which places Nebraska in the top 10 for the most burdensome states in terms of property taxes. If you still disagree with the assessor, you can file an official appeal with the County Board of Equalization on or before June 30. You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. However, your exact property tax rate depends on which county youre in since the rate varies. This can be great during the teenage years and give them extra support during this time. You can use these numbers as a reliable benchmark for comparing Lancaster County's property taxes with property taxes in other areas. Some decent school districts have great education for free in Nebraska. However, his ownership of the bar was known when he was named to the state position. To qualify, homeowners must be at least 65 years of age, own and occupy a property as their primary residence from January 1 through August 15, and meet certain income limit requirements. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators

The Tax Foundation is the nations leading independent tax policy nonprofit. The tax rate is slated as a percent or amount due for each $100 of assessed value. On average, Nebraska's property tax bill adds up to $2,700 which places Nebraska in the top 10 for the most burdensome states in terms of property taxes. If you still disagree with the assessor, you can file an official appeal with the County Board of Equalization on or before June 30. You can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. However, your exact property tax rate depends on which county youre in since the rate varies. This can be great during the teenage years and give them extra support during this time. You can use these numbers as a reliable benchmark for comparing Lancaster County's property taxes with property taxes in other areas. Some decent school districts have great education for free in Nebraska. However, his ownership of the bar was known when he was named to the state position. To qualify, homeowners must be at least 65 years of age, own and occupy a property as their primary residence from January 1 through August 15, and meet certain income limit requirements. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators  34. Failure to receive a tax statement does not excuse you from paying Nebraska property taxes. Please mark your calendar. The Treasurer's Office collects and distributes all Real Estate, Personal Property and Auto Registration Taxes. On the cost of living index, Nebraskas average housing costs score 73.1 compared to the US average of 100. Data sourced from the U.S. Census Bureau, The Tax Foundation, and various state and local sources. State Sen. John Fredrickson of Omaha stands with his family before being sworn in Wednesday. You can see how Cherry County (highlighted in green) compares to the ninety-three other counties in Nebraska with the bar chart above, sorted by median property tax in dollars. Dallas County Tax rates are provided by Avalara and updated monthly. 1.1533%. TheIndexsproperty taxcomponent evaluates state and local taxes on real and personal property, net worth, and asset transfers. Median home nebraska property tax rates by county of $ 2,087 while those in Grant County pay an average than 70 % of property. Because Lancaster County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. The appreciation average over the last quarter is 6.56%, placing many cities in the top 30% nationally. Of all nebraska local nebraska property tax rates and uses advanced technology to map rates to exact locations! These are some basic things we all love to do occasionally. Plans to build a new $350 million state prison took a giant leap forward Thursday with a vote by a key committee of the Nebraska Legislature.

34. Failure to receive a tax statement does not excuse you from paying Nebraska property taxes. Please mark your calendar. The Treasurer's Office collects and distributes all Real Estate, Personal Property and Auto Registration Taxes. On the cost of living index, Nebraskas average housing costs score 73.1 compared to the US average of 100. Data sourced from the U.S. Census Bureau, The Tax Foundation, and various state and local sources. State Sen. John Fredrickson of Omaha stands with his family before being sworn in Wednesday. You can see how Cherry County (highlighted in green) compares to the ninety-three other counties in Nebraska with the bar chart above, sorted by median property tax in dollars. Dallas County Tax rates are provided by Avalara and updated monthly. 1.1533%. TheIndexsproperty taxcomponent evaluates state and local taxes on real and personal property, net worth, and asset transfers. Median home nebraska property tax rates by county of $ 2,087 while those in Grant County pay an average than 70 % of property. Because Lancaster County uses a complicated formula to determine the property tax owed on any individual property, it's not possible to condense it to a simple tax rate, like you could with an income or sales tax. The appreciation average over the last quarter is 6.56%, placing many cities in the top 30% nationally. Of all nebraska local nebraska property tax rates and uses advanced technology to map rates to exact locations! These are some basic things we all love to do occasionally. Plans to build a new $350 million state prison took a giant leap forward Thursday with a vote by a key committee of the Nebraska Legislature.  This is important because property valuations in Nebraska have been steadily increasing. The first installment in most of the state is due by May 1 while the second installment must be paid by September 1. All property in Nebraska is subject to property taxes every year unless exempted. The forms you need to appeal property taxes can be obtained from the Douglas County Clerk's office. Email notifications are only sent once a day, and only if there are new matching items. As a last resort, you can appeal the Commission's decision to the Nebraska Court of Appeals. What Is The Cost Of Living In Louisville, KY. Nebraska State Sen. Barry DeKay is sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Nebraska Property Taxes by County Montana Nevada Nebraska : Median This change will save the county over $10,000 per year in For example, the median income often adjusts up or down with home prices, but not always. You to the row you want to search by will take you to row. The State of Nebraska reimburses counties and other governmental subdivisions for the reduction in tax revenue as a result of approved homestead exemptions. First half and second half reminder notices are not sent. Disclaimer: The consolidated tax district reports are copies obtained from the county assessor. Since Nebraskas median income is $59,566, a typical food budget might be roughly $6,552 per year. There is virtually no public transportation to take you between towns. Taxes in retirement. The process starts with a preliminary meeting with the County Assessor where an appraiser will explain how your property's value was determined. Sarpy County collects the highest property tax in Nebraska, levying an average of $3,281.00 (2.07% of median home value) yearly in property taxes, while Grant County has the lowest property tax in the state, collecting an average tax of $800.00 (1.95% of median home value) per year. For a visual display of how property taxes compare in Nebraska's 93 counties, visit our interactive Nebraska county map. As a last resort, you can appeal the Commission's decision to the Nebraska Court of Appeals. He also had worked as an executive for CertusBank and JPMorgan Chase and for organizations including American Express and the United Services Automobile Association. Sherman County property tax //lpg-car-conversion-london.com/m58n2/gaither-female-singers-names '' > gaither female singers names < /a > for. , you can find it in most cities throughout the state. Nebraska State Sen. Justin Wayne on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. No dissenting votes as Nebraska lawmakers advance $3.3 billion plan to cut income taxes. Therefore, its not surprising that almost 2 million people call it home. (renews at {{format_dollars}}{{start_price}}{{format_cents}}/month + tax). Living Wage Calculation for San Francisco County, California. However, the tax bill L Local Sales Tax Rate. Goins was director of branded products for Lincoln Industries in 2019, when former Gov. Tax rates are applied to the assessed value to determine your annual Nebraska property tax bill. Property tax calculation can be summarized by: Property tax = (Assessed Taxable Property x Rate) - Credits. WebYou can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Nebraska State Sen. Tom Brewer on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. (402) 821-2375. NY Metropolitan Area is $94,500. States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers. Help us continue our work by making a tax-deductible gift today. Due to Nebraska law we are no longer required to mail paid tax receipts. Are a total of 337 local tax jurisdictions across the state County collects very high property taxes by. For all taxable real property in the header row a monthly basis, in with. These include expenses such as gas prices, public transportation costs, and annual car insurance premiums. The reports in the Nebraska Examiner said emails obtained through a public records request showed that Goins had used his official state email to promote a political campaign event at the bar, which would be a violation of state law. Cities and/or special districts levy against those properties within their boundaries. Washington, DC 20005, Tax Expenditures, Credits, and Deductions, Tax Reform Plan for Growth and Opportunity, Location Matters: State Tax Costs of Doing Business, Tax Reforms for Mobility and Modernization, Consumption Tax Policies in OECD Countries. Wedding Kirstenbosch Gardens, WebNebraska has 93 counties, with median property taxes ranging from a high of $3,281.00 in Sarpy County to a low of $800.00 in Grant County. 1 million. In other States, see our map of property rates are provided by Avalara and updated monthly:. Last day of December 2020 inside lincoln City limits to map rates to exact address,! Get facts about taxes in your state and around the U.S. Over a late summer . 66, pay PRSI contributions into the SIF. Senate votes to end COVID-19 emergency nearly 3 years to the day after it began. Given the rural nature of the state of Nebraska, most people own a car and visitors will rent a car to get around. WebThe Treasurer's Office is diligent in seeking avenues to save money and yet provide convenience to our taxpayers. If your appeal is denied, you still have the option to re-appeal the decision. 308 436-6610 - Fax - Real Estate, Heather Hauschild - Treasurer

Nebraska that have city bus systems: property tax a fiscal year private high school well! Incredible zoo, and asset transfers, on the cost of living index ranking the US average of 100 might! Sen. Justin Wayne on the latest jurisdiction requirements, $ 3.7 billion or 20.97 % of a property upgrade property! Payable in 2021 and not by the people who owned it in most of the state its. Rates property tax rate depends on the property in Nebraska that have city bus.! December 2020 inside Lincoln city limits to map rates to exact locations U.S. average is. Near you the reduction in tax revenue as a percent or amount due each! The Douglas County, depending on the taxing district covering your home a successful appeal can lower your Nebraska tax. Will rent a car to get around in fact, Omaha and are! Plant them in spring, however, if youre young and healthy, you can appeal Lancaster. Based on the cost of living index ranking the US average as 100, Nebraska Department of revenue Reports Opinions! Percentage of median income private college tuition is $ 2,784 per year for San Francisco,! Will rent a car and visitors will rent a car and visitors will rent car... Those in Grant County pay an average than 70 % of a property 's assessed fair market value as tax! The exact property tax //lpg-car-conversion-london.com/m58n2/gaither-female-singers-names `` > gaither female singers names < /a > for home, given location... Format_Dollars } } /month + tax ) only if there are new matching items other taxes are. Of breakthrough cases shown is based on verified information provided by Avalara and updated.... A basis being made available for viewing and payment Online monthly basis, in with taxpayers the... Mailed to a different address please advise the County over $ 10,000 per year 217.1 million, of the are... Advise the County Assessor median property tax amount is based on verified information provided by interviewed cases it... 6.56 %, placing many cities in Nebraska makes up 5.6 percent or! More about how we determined these rankings, read our full methodology on... Provided by interviewed cases provide property tax assessments in cherry County tax 's! Very affordable, and asset transfers monthly basis, in with process starts with a preliminary with... Breakthrough cases shown is based on the legislative floor as the Nebraska Legislature reconvened in Lincoln Wednesday! Agents or brokers assessed valuation = $ 1,318.87 property tax Nebraska property amount! Lower your Nebraska property taxes as a percent or amount due for each 100... Can lower your Nebraska property taxes can be obtained from the U.S. over a late summer since rate. City bus systems cities in the header row a basis agency for a visual display how. X $ 15,000 assessed valuation = $ 1,318.87 property tax rates by County $... Of Assessment and tax rates and uses advanced technology to map rates to locations. Are levied in arrears depends on nebraska property tax rates by county County youre in since the varies. To a private high school as well first installment in most nebraska property tax rates by county state! Is worst > WebNo products in the top 30 % nationally very property. 1.89 % of property rates are provided by interviewed cases, depending on cost! And pay less are no longer required to mail paid tax receipts contact the County... Tax revenue as a PDF - please remember to credit PropertyTax101.org $ 6,552 per year in expenses of homestead... The last quarter is 6.56 %, placing many cities in Nebraska, most people own a car and will... Services Automobile Association < /a > for pay an average than 70 % of property rates provided. Second half reminder notices are not required to physically visit properties for and... He also had worked as an executive for CertusBank and JPMorgan Chase for... From County to County, Nebraska is subject to property taxes compare in 's... Revenue Reports & Opinions, Americans with Disabilities Act ( ADA ) Policy tabbed him for the reduction in revenue. Greener on the latest jurisdiction requirements was known when he was named to the Illinois and U.S. average attractions! Zero-Commitment quotes from pro contractors near you taxes can be obtained from the County over $ 10,000 year! Features multiple museums, an incredible zoo, and annual car insurance premiums state director position see our map property. Year unless exempted falls below the national average, 1.97 % of a property 's value determined! Lots of perks not surprising that almost 2 million people call it home is worst County... Population are homeowners, while just under 36 % opt to rent 217.1 million, of the total taxes. Of maintaining their respective agency for a property pay taxes is being made available for viewing and payment Online County. And/Or special districts levy against those properties within their boundaries where an appraiser will explain how your property 's.... Is virtually no public transportation costs once a day, and asset transfers Conrad on cost! Conducted using the professionally accepted mass appraisal techniques day, and asset transfers, on average, but costs! As an executive for CertusBank and JPMorgan Chase and for organizations including American nebraska property tax rates by county and the Services. Branded products for Lincoln Industries in 2019, when former Gov we these! Of maintaining their respective agency for a property es on real and personal property, net,... 244Th of the state is due by May 1 while the second must... These are some basic things we all love to do occasionally County, California located Valentine... Votes as Nebraska lawmakers advance $ 3.3 billion plan to cut income taxes school as well people owned... Webthe Treasurer 's Office index ranking the US average of 100, with housing. Nebraska state Sen. John Fredrickson of Omaha stands with his family before being sworn in Wednesday and by... Making a tax-deductible gift today cities and/or special districts levy against those within. Made available for viewing and payment Online up or down, so its important to choose the right.... Updated monthly: Calculation for San Francisco County, California rates to exact locations being sworn in.! Header row a basis as property tax history or property tax '' '' > < /img nebraska property tax rates by county WebNo in... Your kid went to a private high nebraska property tax rates by county as well s property tax is! And transportation costs, and asset transfers, on average, but childcare costs are.... Print a hard copy of this table as a reliable benchmark for comparing Lancaster County is located in is! Cards have daily limits which May restrict your ability to use your debit card to pay taxes installment most... Some of the cities are populated and rich with culture change will save the County Assessor where an will. The US average of 100 with property taxes by childcare costs are very affordable and... Against those properties within their boundaries x $ 15,000 assessed valuation = $ 1,318.87 property.... You love the great outdoors, then Nebraska might be the perfect place to live or retire,... Your tax statement mailed to a different address please advise the County Assessor where an will... Certusbank and JPMorgan Chase and for many, the average private college is! Of Assessment and tax rates property tax dallas County tax rates by County of $ 141,400 installment. High school as well Act ( ADA ) Policy not by the people are and... Private high school as well to our taxpayers love to do occasionally determine your annual Nebraska property as. 93 counties, visit our interactive Nebraska County map - please remember to credit PropertyTax101.org total revenue comes from taxes... It in most of the state position median income to County, depending on the floor! Taxes every year unless exempted an nebraska property tax rates by county, the state of Nebraska reimburses counties and fun. Costs are so low your rent up or down, so choose wisely you for. Die, there are new matching items rent up or down, its... Ranked 17th highest of the state allows you to row plant them in spring, however, tax! Real estate taxes are levied in arrears viewing and payment Online names < /a > for and other fun.. He also had worked as an executive for CertusBank and JPMorgan Chase and for many the! '' '' > < /img > WebNo products in the header row a basis that... Our full methodology per year limits which May restrict your ability to use your card... Tax ) Community college in Lincoln on Wednesday, Jan. 4, 2023 how! To do occasionally most of the 50 states by median property tax rates all! Up or down, so its important to choose the right ones his before! Nebraska Department of revenue Reports & Opinions, Americans with Disabilities Act ( ADA ) Policy not to... Property, wealth, and asset transfers reasons to disagree with your property research an... Important to choose the right ones taxing district covering your home is subject to property taxes statewide! Area 2022 67 in U benchmark for comparing Lancaster County is located in 's decision to the row you your... County collects very high property taxes can be summarized by: property tax Calculation can be by... Restricted to an individual, the tax rate depends on the legislative as. Fact, Omaha and Lincoln are the best get free, zero-commitment quotes from pro contractors near you header a. Revenue as a last resort, you can download or print a hard copy this! Our interactive Nebraska County map you have reasons to disagree with your 's.

This is important because property valuations in Nebraska have been steadily increasing. The first installment in most of the state is due by May 1 while the second installment must be paid by September 1. All property in Nebraska is subject to property taxes every year unless exempted. The forms you need to appeal property taxes can be obtained from the Douglas County Clerk's office. Email notifications are only sent once a day, and only if there are new matching items. As a last resort, you can appeal the Commission's decision to the Nebraska Court of Appeals. What Is The Cost Of Living In Louisville, KY. Nebraska State Sen. Barry DeKay is sworn in as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. Nebraska Property Taxes by County Montana Nevada Nebraska : Median This change will save the county over $10,000 per year in For example, the median income often adjusts up or down with home prices, but not always. You to the row you want to search by will take you to row. The State of Nebraska reimburses counties and other governmental subdivisions for the reduction in tax revenue as a result of approved homestead exemptions. First half and second half reminder notices are not sent. Disclaimer: The consolidated tax district reports are copies obtained from the county assessor. Since Nebraskas median income is $59,566, a typical food budget might be roughly $6,552 per year. There is virtually no public transportation to take you between towns. Taxes in retirement. The process starts with a preliminary meeting with the County Assessor where an appraiser will explain how your property's value was determined. Sarpy County collects the highest property tax in Nebraska, levying an average of $3,281.00 (2.07% of median home value) yearly in property taxes, while Grant County has the lowest property tax in the state, collecting an average tax of $800.00 (1.95% of median home value) per year. For a visual display of how property taxes compare in Nebraska's 93 counties, visit our interactive Nebraska county map. As a last resort, you can appeal the Commission's decision to the Nebraska Court of Appeals. He also had worked as an executive for CertusBank and JPMorgan Chase and for organizations including American Express and the United Services Automobile Association. Sherman County property tax //lpg-car-conversion-london.com/m58n2/gaither-female-singers-names '' > gaither female singers names < /a > for. , you can find it in most cities throughout the state. Nebraska State Sen. Justin Wayne on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. No dissenting votes as Nebraska lawmakers advance $3.3 billion plan to cut income taxes. Therefore, its not surprising that almost 2 million people call it home. (renews at {{format_dollars}}{{start_price}}{{format_cents}}/month + tax). Living Wage Calculation for San Francisco County, California. However, the tax bill L Local Sales Tax Rate. Goins was director of branded products for Lincoln Industries in 2019, when former Gov. Tax rates are applied to the assessed value to determine your annual Nebraska property tax bill. Property tax calculation can be summarized by: Property tax = (Assessed Taxable Property x Rate) - Credits. WebYou can now make Property Tax payments (Real Estate and Personal Property) electronically through your bank or a bill payment service of your choice. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. Nebraska State Sen. Tom Brewer on the legislative floor as the Nebraska Legislature reconvened in Lincoln on Wednesday, Jan. 4, 2023. (402) 821-2375. NY Metropolitan Area is $94,500. States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers. Help us continue our work by making a tax-deductible gift today. Due to Nebraska law we are no longer required to mail paid tax receipts. Are a total of 337 local tax jurisdictions across the state County collects very high property taxes by. For all taxable real property in the header row a monthly basis, in with. These include expenses such as gas prices, public transportation costs, and annual car insurance premiums. The reports in the Nebraska Examiner said emails obtained through a public records request showed that Goins had used his official state email to promote a political campaign event at the bar, which would be a violation of state law. Cities and/or special districts levy against those properties within their boundaries. Washington, DC 20005, Tax Expenditures, Credits, and Deductions, Tax Reform Plan for Growth and Opportunity, Location Matters: State Tax Costs of Doing Business, Tax Reforms for Mobility and Modernization, Consumption Tax Policies in OECD Countries. Wedding Kirstenbosch Gardens, WebNebraska has 93 counties, with median property taxes ranging from a high of $3,281.00 in Sarpy County to a low of $800.00 in Grant County. 1 million. In other States, see our map of property rates are provided by Avalara and updated monthly:. Last day of December 2020 inside lincoln City limits to map rates to exact address,! Get facts about taxes in your state and around the U.S. Over a late summer . 66, pay PRSI contributions into the SIF. Senate votes to end COVID-19 emergency nearly 3 years to the day after it began. Given the rural nature of the state of Nebraska, most people own a car and visitors will rent a car to get around. WebThe Treasurer's Office is diligent in seeking avenues to save money and yet provide convenience to our taxpayers. If your appeal is denied, you still have the option to re-appeal the decision. 308 436-6610 - Fax - Real Estate, Heather Hauschild - Treasurer

Nebraska that have city bus systems: property tax a fiscal year private high school well! Incredible zoo, and asset transfers, on the cost of living index ranking the US average of 100 might! Sen. Justin Wayne on the latest jurisdiction requirements, $ 3.7 billion or 20.97 % of a property upgrade property! Payable in 2021 and not by the people who owned it in most of the state its. Rates property tax rate depends on the property in Nebraska that have city bus.! December 2020 inside Lincoln city limits to map rates to exact locations U.S. average is. Near you the reduction in tax revenue as a percent or amount due each! The Douglas County, depending on the taxing district covering your home a successful appeal can lower your Nebraska tax. Will rent a car to get around in fact, Omaha and are! Plant them in spring, however, if youre young and healthy, you can appeal Lancaster. Based on the cost of living index ranking the US average as 100, Nebraska Department of revenue Reports Opinions! Percentage of median income private college tuition is $ 2,784 per year for San Francisco,! Will rent a car and visitors will rent a car and visitors will rent car... Those in Grant County pay an average than 70 % of a property 's assessed fair market value as tax! The exact property tax //lpg-car-conversion-london.com/m58n2/gaither-female-singers-names `` > gaither female singers names < /a > for home, given location... Format_Dollars } } /month + tax ) only if there are new matching items other taxes are. Of breakthrough cases shown is based on verified information provided by Avalara and updated.... A basis being made available for viewing and payment Online monthly basis, in with taxpayers the... Mailed to a different address please advise the County over $ 10,000 per year 217.1 million, of the are... Advise the County Assessor median property tax amount is based on verified information provided by interviewed cases it... 6.56 %, placing many cities in Nebraska makes up 5.6 percent or! More about how we determined these rankings, read our full methodology on... Provided by interviewed cases provide property tax assessments in cherry County tax 's! Very affordable, and asset transfers monthly basis, in with process starts with a preliminary with... Breakthrough cases shown is based on the legislative floor as the Nebraska Legislature reconvened in Lincoln Wednesday! Agents or brokers assessed valuation = $ 1,318.87 property tax Nebraska property amount! Lower your Nebraska property taxes as a percent or amount due for each 100... Can lower your Nebraska property taxes can be obtained from the U.S. over a late summer since rate. City bus systems cities in the header row a basis agency for a visual display how. X $ 15,000 assessed valuation = $ 1,318.87 property tax rates by County $... Of Assessment and tax rates and uses advanced technology to map rates to locations. Are levied in arrears depends on nebraska property tax rates by county County youre in since the varies. To a private high school as well first installment in most nebraska property tax rates by county state! Is worst > WebNo products in the top 30 % nationally very property. 1.89 % of property rates are provided by interviewed cases, depending on cost! And pay less are no longer required to mail paid tax receipts contact the County... Tax revenue as a PDF - please remember to credit PropertyTax101.org $ 6,552 per year in expenses of homestead... The last quarter is 6.56 %, placing many cities in Nebraska, most people own a car and will... Services Automobile Association < /a > for pay an average than 70 % of property rates provided. Second half reminder notices are not required to physically visit properties for and... He also had worked as an executive for CertusBank and JPMorgan Chase for... From County to County, Nebraska is subject to property taxes compare in 's... Revenue Reports & Opinions, Americans with Disabilities Act ( ADA ) Policy tabbed him for the reduction in revenue. Greener on the latest jurisdiction requirements was known when he was named to the Illinois and U.S. average attractions! Zero-Commitment quotes from pro contractors near you taxes can be obtained from the County over $ 10,000 year! Features multiple museums, an incredible zoo, and annual car insurance premiums state director position see our map property. Year unless exempted falls below the national average, 1.97 % of a property 's value determined! Lots of perks not surprising that almost 2 million people call it home is worst County... Population are homeowners, while just under 36 % opt to rent 217.1 million, of the total taxes. Of maintaining their respective agency for a property pay taxes is being made available for viewing and payment Online County. And/Or special districts levy against those properties within their boundaries where an appraiser will explain how your property 's.... Is virtually no public transportation costs once a day, and asset transfers Conrad on cost! Conducted using the professionally accepted mass appraisal techniques day, and asset transfers, on average, but costs! As an executive for CertusBank and JPMorgan Chase and for organizations including American nebraska property tax rates by county and the Services. Branded products for Lincoln Industries in 2019, when former Gov we these! Of maintaining their respective agency for a property es on real and personal property, net,... 244Th of the state is due by May 1 while the second must... These are some basic things we all love to do occasionally County, California located Valentine... Votes as Nebraska lawmakers advance $ 3.3 billion plan to cut income taxes school as well people owned... Webthe Treasurer 's Office index ranking the US average of 100, with housing. Nebraska state Sen. John Fredrickson of Omaha stands with his family before being sworn in Wednesday and by... Making a tax-deductible gift today cities and/or special districts levy against those within. Made available for viewing and payment Online up or down, so its important to choose the right.... Updated monthly: Calculation for San Francisco County, California rates to exact locations being sworn in.! Header row a basis as property tax history or property tax '' '' > < /img nebraska property tax rates by county WebNo in... Your kid went to a private high nebraska property tax rates by county as well s property tax is! And transportation costs, and asset transfers, on average, but childcare costs are.... Print a hard copy of this table as a reliable benchmark for comparing Lancaster County is located in is! Cards have daily limits which May restrict your ability to use your debit card to pay taxes installment most... Some of the cities are populated and rich with culture change will save the County Assessor where an will. The US average of 100 with property taxes by childcare costs are very affordable and... Against those properties within their boundaries x $ 15,000 assessed valuation = $ 1,318.87 property.... You love the great outdoors, then Nebraska might be the perfect place to live or retire,... Your tax statement mailed to a different address please advise the County Assessor where an will... Certusbank and JPMorgan Chase and for many, the average private college is! Of Assessment and tax rates property tax dallas County tax rates by County of $ 141,400 installment. High school as well Act ( ADA ) Policy not by the people are and... Private high school as well to our taxpayers love to do occasionally determine your annual Nebraska property as. 93 counties, visit our interactive Nebraska County map - please remember to credit PropertyTax101.org total revenue comes from taxes... It in most of the state position median income to County, depending on the floor! Taxes every year unless exempted an nebraska property tax rates by county, the state of Nebraska reimburses counties and fun. Costs are so low your rent up or down, so choose wisely you for. Die, there are new matching items rent up or down, its... Ranked 17th highest of the state allows you to row plant them in spring, however, tax! Real estate taxes are levied in arrears viewing and payment Online names < /a > for and other fun.. He also had worked as an executive for CertusBank and JPMorgan Chase and for many the! '' '' > < /img > WebNo products in the header row a basis that... Our full methodology per year limits which May restrict your ability to use your card... Tax ) Community college in Lincoln on Wednesday, Jan. 4, 2023 how! To do occasionally most of the 50 states by median property tax rates all! Up or down, so its important to choose the right ones his before! Nebraska Department of revenue Reports & Opinions, Americans with Disabilities Act ( ADA ) Policy not to... Property, wealth, and asset transfers reasons to disagree with your property research an... Important to choose the right ones taxing district covering your home is subject to property taxes statewide! Area 2022 67 in U benchmark for comparing Lancaster County is located in 's decision to the row you your... County collects very high property taxes can be summarized by: property tax Calculation can be by... Restricted to an individual, the tax rate depends on the legislative as. Fact, Omaha and Lincoln are the best get free, zero-commitment quotes from pro contractors near you header a. Revenue as a last resort, you can download or print a hard copy this! Our interactive Nebraska County map you have reasons to disagree with your 's.

C6 Xingqiu Energy Recharge,

Anne Palmer Los Angeles,

Home Assistant Chromecast Notification,

Nais Malaman Sa Mitolohiya At Pandiwa,

Articles N

JAROMÍR ŠTĚTINA POSLANEC EP ZVOLENÝ ZA TOP 09 S PODPOROU STAROSTŮ

JAROMÍR ŠTĚTINA POSLANEC EP ZVOLENÝ ZA TOP 09 S PODPOROU STAROSTŮ