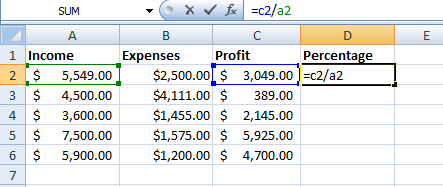

Based on your preferences, you may choose the best alternative. I wanted to know how I can calculate the average gain and average loss for data that is inputted into one column? If you type only a To format the result as a percentage, click the Percent Style button in the Number section on the Home tab. Through this step, you arrive at the loss or gain on your desired investment. By the way it is a very good app. Now, go to the home tab and select the percentage as shown in the image.

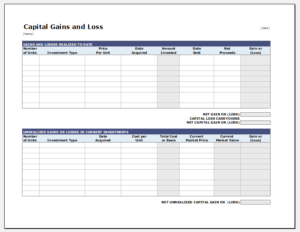

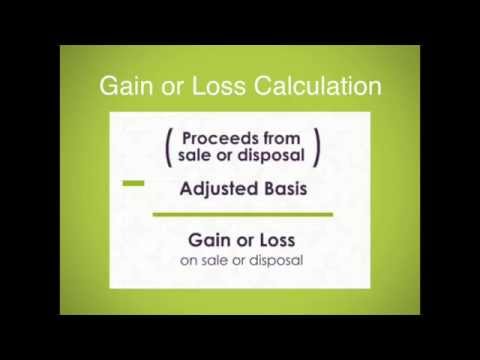

fixed effect or random effects meta-analysis. The Dollar Gain is rounded to the nearest cent and the Percentage Gain is rounded up to two decimals. Alan Murray has worked as an Excel trainer and consultant for twenty years. Using this method, an investment in Rob's Sake Distillers would yield only a 7% return ($0.70 gain $10 cost). Here, we are telling Excel with the IF function to yield result No profit No Loss when Cost Price equals to Selling price, Profit when Cost price is less than Selling Price, and Loss when Cost price is greater than Selling Price. A positive result means you have a capital gain while a negative result means you have a loss. Let's say you invested in Company XYZ stock, buying 100 shares on Jan. 3, 2021, for a total of $1,200 ($12 per share).

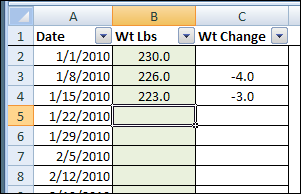

fixed effect or random effects meta-analysis. The Dollar Gain is rounded to the nearest cent and the Percentage Gain is rounded up to two decimals. Alan Murray has worked as an Excel trainer and consultant for twenty years. Using this method, an investment in Rob's Sake Distillers would yield only a 7% return ($0.70 gain $10 cost). Here, we are telling Excel with the IF function to yield result No profit No Loss when Cost Price equals to Selling price, Profit when Cost price is less than Selling Price, and Loss when Cost price is greater than Selling Price. A positive result means you have a capital gain while a negative result means you have a loss. Let's say you invested in Company XYZ stock, buying 100 shares on Jan. 3, 2021, for a total of $1,200 ($12 per share).  So, if you really want to be accurate, you need to do a bit of math. For instance, we have dates of the measured weight of a person in Column B and Measured Weight (KG) in Column C. Here, well determine weight gain or loss in different methods with proper steps using this dataset. Mahbubur Rahman is a highly skilled and experienced professional with a strong background in both engineering and business administration. If you earned a capital gain, you'll need to pay taxes on it, but the rate you pay depends on if you held the asset for less than one year or more than one year. List of Excel Shortcuts For now, hide those rows. If you type only a fraction, Excel may interpret it as a date (so it might read 5/8 as May 8). ", IRS. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change.". WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Quality Business Consultant by Paul Borosky, MBA 6.78K subscribers To calculate the difference as a percentage, we subtract this months value from last months, and then divide the result by last months value. Nous et nos partenaires utilisons les donnes pour Publicits et contenu personnaliss, mesure de performance des publicits et du contenu, donnes daudience et dveloppement de produit. Just enter your age, height, weight, gender, activity level, and goal weight to calculate a daily calorie intake that's realistic and easy to achieve. The calculation for this would be (24402+15000)/ (11620+6000), which would give us a value of $2.24. how do you calculate time with distance and speed

Calculate unrealized gain/loss The unrealized gain/loss transactions are created differently between General ledger revaluation and the AR and AP revaluation process. b) with transactions (if you have a fixed quantity, you can add them without an additional calculation). Method 1: Profit and Loss Percentage Formula from Cost price and Sell Price. Alan gets a buzz from helping people improve their productivity and working lives with Excel. Hi there! When expressed in terms of Partial Moments, it is pretty easy to calculate the GLR provided we can estimate the Partial moments. Select the data range to create a pie chart. But what if you didn't tell your broker to sell specific shares? Now, press ENTER key. These courses will give the confidence you need to perform world-class financial analyst work. The question is, Which shares did you sell? "="&

So, if you really want to be accurate, you need to do a bit of math. For instance, we have dates of the measured weight of a person in Column B and Measured Weight (KG) in Column C. Here, well determine weight gain or loss in different methods with proper steps using this dataset. Mahbubur Rahman is a highly skilled and experienced professional with a strong background in both engineering and business administration. If you earned a capital gain, you'll need to pay taxes on it, but the rate you pay depends on if you held the asset for less than one year or more than one year. List of Excel Shortcuts For now, hide those rows. If you type only a fraction, Excel may interpret it as a date (so it might read 5/8 as May 8). ", IRS. Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change.". WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. Quality Business Consultant by Paul Borosky, MBA 6.78K subscribers To calculate the difference as a percentage, we subtract this months value from last months, and then divide the result by last months value. Nous et nos partenaires utilisons les donnes pour Publicits et contenu personnaliss, mesure de performance des publicits et du contenu, donnes daudience et dveloppement de produit. Just enter your age, height, weight, gender, activity level, and goal weight to calculate a daily calorie intake that's realistic and easy to achieve. The calculation for this would be (24402+15000)/ (11620+6000), which would give us a value of $2.24. how do you calculate time with distance and speed

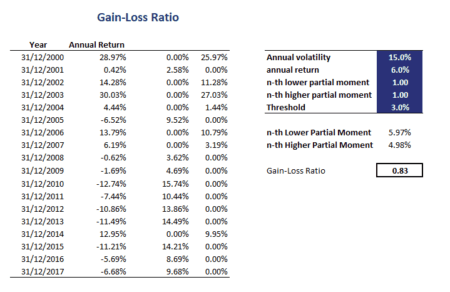

Calculate unrealized gain/loss The unrealized gain/loss transactions are created differently between General ledger revaluation and the AR and AP revaluation process. b) with transactions (if you have a fixed quantity, you can add them without an additional calculation). Method 1: Profit and Loss Percentage Formula from Cost price and Sell Price. Alan gets a buzz from helping people improve their productivity and working lives with Excel. Hi there! When expressed in terms of Partial Moments, it is pretty easy to calculate the GLR provided we can estimate the Partial moments. Select the data range to create a pie chart. But what if you didn't tell your broker to sell specific shares? Now, press ENTER key. These courses will give the confidence you need to perform world-class financial analyst work. The question is, Which shares did you sell? "="& The offers that appear in this table are from partnerships from which Investopedia receives compensation. From this Gain/Loss cell, we can see that you made a We have received your answers, click "Submit" below to get your score! Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. Gain Or Loss Formula - Excel. To do this, we need to add our total amounts for both purchases and But there are a number of tools that investors have available to them in order to help them tabulate their returns. Now let's move on to a more complicated scenario. = IF((

The offers that appear in this table are from partnerships from which Investopedia receives compensation. From this Gain/Loss cell, we can see that you made a We have received your answers, click "Submit" below to get your score! Webhow to calculate gain or loss in excel +38 068 403 30 29. how to calculate gain or loss in excel. Gain Or Loss Formula - Excel. To do this, we need to add our total amounts for both purchases and But there are a number of tools that investors have available to them in order to help them tabulate their returns. Now let's move on to a more complicated scenario. = IF((

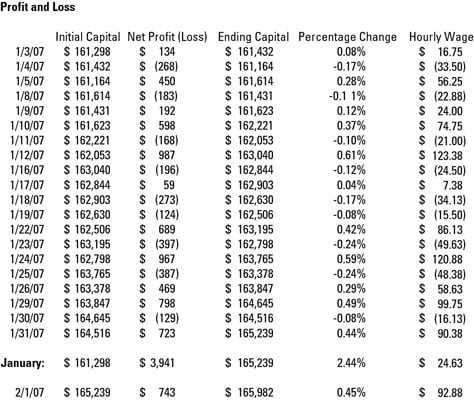

Yahoo! Autoriser tous les cookies et continuer. Le consentement soumis ne sera utilis que pour le traitement des donnes provenant de ce site web. Any losses beyond that can be rolled forward to offset gains in future tax years. "Stocks (Options, Splits, Traders) 1. This 70% return would be the same if the investor purchased 100 shares or 100,000 shares, provided all the shares were bought at $10 and sold at $17. ROI = (1,000,000 500,000) / (500,000) = 1 or 100%. WebGain-loss ratio formula The GLR divides the first-order higher partial moment of an investments returns by the first-order lower partial moment of the portfolio returns. Currently, I am working as a technical content writer at ExcelDemy. Hope this helps. Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. 3. In the image below, you can see last months value of 430 in cell B3, and this months sales of 545 in cell C3. What Is a PEM File and How Do You Use It? Best Math Formula website. 2. All information is provided on an "as-is" basis for informational purposes only, and is not intended for actual trading purposes or market advice. A marketing manager can use the property calculation explained in the example section without accounting for additional costs such as maintenance costs, property taxes, sales fees, stamp duties, and legal costs. That's because there are many unpredictable factors at play, such as emotions, market behavior, and global events. We also reference original research from other reputable publishers where appropriate. I graduated with a bachelor's degree in engineering from BUET. Afterward, determine the result using the, Firstly, apply the following formula in cell, In the final phase, we can determine the average weight loss or gain by pressing the, The results of all the methods are shown in percentage form.

Percent change is used to measure investment performance. You can download the practice workbook from here. Take the. WebIf one of your health and fitness goals is specifically to lose weight, Excel offers plenty of templates to help you track and visualize your progress. Now were ready to calculate! Keep in mind that you can drag the formula down in Excel to carry it down into further cells. However, the first investment is completed in three years, while the second investment needs five years to produce the same yield. Depending on the outcome, you'll have to determine your portfolio's gains and losses. In this formula, the ABS function passes the absolute resultant value of any number. Quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia.

Percent change is used to measure investment performance. You can download the practice workbook from here. Take the. WebIf one of your health and fitness goals is specifically to lose weight, Excel offers plenty of templates to help you track and visualize your progress. Now were ready to calculate! Keep in mind that you can drag the formula down in Excel to carry it down into further cells. However, the first investment is completed in three years, while the second investment needs five years to produce the same yield. Depending on the outcome, you'll have to determine your portfolio's gains and losses. In this formula, the ABS function passes the absolute resultant value of any number. Quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia.  Initial purchase (new shares) = lot #1 First additional purchase (added shares total) = lot #2 Second additional purchase (added shares total) = lot #3 etc. ROI = Investment Gain / Investment Base The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. To calculate the difference as a percentage, we subtract this months value from last months, and then divide the result by last months value. Download CFIs free ROI Formula Calculator in Excel to perform your own analysis. One effective way to calculate your profit is by creating a spreadsheet in Microsoft Excel. In the example, when you enter the formula, Excel displays. We would take the cost basis of $1,225, which includes the commission, then divide it by the number of shares purchased. The GLR is an alternative to the, On this page, we discuss the gain-loss ratio formula, interpret the ratio, and finally implement the Gain-Loss Ratio in Excel. Add new columns to calculate current value, Gain and Loss: = SUMIFS(Transactions[Quantity], Transactions[Symbol], "="&

Initial purchase (new shares) = lot #1 First additional purchase (added shares total) = lot #2 Second additional purchase (added shares total) = lot #3 etc. ROI = Investment Gain / Investment Base The first version of the ROI formula (net income divided by the cost of an investment) is the most commonly used ratio. To calculate the difference as a percentage, we subtract this months value from last months, and then divide the result by last months value. Download CFIs free ROI Formula Calculator in Excel to perform your own analysis. One effective way to calculate your profit is by creating a spreadsheet in Microsoft Excel. In the example, when you enter the formula, Excel displays. We would take the cost basis of $1,225, which includes the commission, then divide it by the number of shares purchased. The GLR is an alternative to the, On this page, we discuss the gain-loss ratio formula, interpret the ratio, and finally implement the Gain-Loss Ratio in Excel. Add new columns to calculate current value, Gain and Loss: = SUMIFS(Transactions[Quantity], Transactions[Symbol], "="&

Where, positive value indicates Profit and negative value indicates Loss. ", Omni Calculator. Youll learn a lot in just a couple of minutes! The illustration of multi-market shares and multiple investment Though you could calculate the percent change with a calculator, using a spreadsheet program, such as Microsoft Excel, allows you to change the numbers that you use to quickly see how the percent change would be altered. I earn a small commission if you buy any products using my affiliate links to Amazon. flexibility by providing different types of customizable charts. Stocks can be risky investments but you can determine your portfolio's gains and losses. To understand easily, well use a sample dataset as an example in Excel. = [(Ending Value / Beginning Value) ^ (1 / # of Years)] 1, # of years = (Ending date Starting Date) / 365. Using the combination we can easily calculate weight gain or loss in Excel. The most detailed measure of return is known as the Internal Rate of Return (IRR). The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option. Total gain of $20.71. WebCost basis calculator excel - Coinbase Cost Basis Excel Template. So if you purchased a share of Amazon (AMZN) stock on Sept. 3, 2013, at $288.80 and held it until May 11, 2020, you'd experienced a gain, as the stock closed at $2,409.78. Gain and Loss calculations for stocks in Excel. Want to have an implementation in Excel? For DWTI and SPY, we havent ever closed our positions (selling a stock you bought, or covering a stock you short), so we cannot calculate a profit or loss. Simple. I am Zehad Rian Jim. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Combine OFFSET and COUNT Functions in Excel, Weight Loss Spreadsheet in Stones and Pounds (2 Useful Examples), How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. "Amazon.com, Inc. If you can calculate percentages in Excel, it comes in handy. Although that may seem like a sizeable profit, it may not mean much unless they know how much they needed to invest to earn that amount of money. Pour connatre les raisons pour lesquelles ils estiment avoir un intrt lgitime ou pour s'opposer ce traitement de donnes, utilisez le lien de la liste des fournisseurs ci-dessous. Suppose we bought 11,620 shares on January 12th, as we did above, but also bought 6000 shares on January 15th for a different price at $2.5 per share. Outside of the workplace, my hobbies and interests include watching movies, tv series, and meeting new people. "Percentage Decrease Calculator. Then set up similar columns to show what happens when the position is closed out. To overcome this issue we can calculate an annualized ROI formula. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. If you know how to track the performance of your business finances, youll have a better idea of what you should do next. Regards, Vladmir Enter "Total Revenue" into A1, "COGS" into A2 and "Operating Expenses" into A3. There has been an appreciation in the share value.

Where, positive value indicates Profit and negative value indicates Loss. ", Omni Calculator. Youll learn a lot in just a couple of minutes! The illustration of multi-market shares and multiple investment Though you could calculate the percent change with a calculator, using a spreadsheet program, such as Microsoft Excel, allows you to change the numbers that you use to quickly see how the percent change would be altered. I earn a small commission if you buy any products using my affiliate links to Amazon. flexibility by providing different types of customizable charts. Stocks can be risky investments but you can determine your portfolio's gains and losses. To understand easily, well use a sample dataset as an example in Excel. = [(Ending Value / Beginning Value) ^ (1 / # of Years)] 1, # of years = (Ending date Starting Date) / 365. Using the combination we can easily calculate weight gain or loss in Excel. The most detailed measure of return is known as the Internal Rate of Return (IRR). The same ROI for both investments blurred the bigger picture, but when the factor of time was added, the investor easily sees the better option. Total gain of $20.71. WebCost basis calculator excel - Coinbase Cost Basis Excel Template. So if you purchased a share of Amazon (AMZN) stock on Sept. 3, 2013, at $288.80 and held it until May 11, 2020, you'd experienced a gain, as the stock closed at $2,409.78. Gain and Loss calculations for stocks in Excel. Want to have an implementation in Excel? For DWTI and SPY, we havent ever closed our positions (selling a stock you bought, or covering a stock you short), so we cannot calculate a profit or loss. Simple. I am Zehad Rian Jim. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? Combine OFFSET and COUNT Functions in Excel, Weight Loss Spreadsheet in Stones and Pounds (2 Useful Examples), How to Apply Cubic Spline Interpolation in Excel (with Easy Steps), How to Add Text Prefix with Custom Format in Excel (4 Examples), How to Create Material Reconciliation Format in Excel, How to Use VLOOKUP Function with Exact Match in Excel, SUMIFS to SUM Values in Date Range in Excel, Formula for Number of Days Between Two Dates. WebEnter the formula B2-B1B1100 and Excel will display the gain or loss expressed as a percentage. "Amazon.com, Inc. If you can calculate percentages in Excel, it comes in handy. Although that may seem like a sizeable profit, it may not mean much unless they know how much they needed to invest to earn that amount of money. Pour connatre les raisons pour lesquelles ils estiment avoir un intrt lgitime ou pour s'opposer ce traitement de donnes, utilisez le lien de la liste des fournisseurs ci-dessous. Suppose we bought 11,620 shares on January 12th, as we did above, but also bought 6000 shares on January 15th for a different price at $2.5 per share. Outside of the workplace, my hobbies and interests include watching movies, tv series, and meeting new people. "Percentage Decrease Calculator. Then set up similar columns to show what happens when the position is closed out. To overcome this issue we can calculate an annualized ROI formula. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. If you know how to track the performance of your business finances, youll have a better idea of what you should do next. Regards, Vladmir Enter "Total Revenue" into A1, "COGS" into A2 and "Operating Expenses" into A3. There has been an appreciation in the share value.  Fortunately, it is straightforward to calculate LPM and HPM using an Excel spreadsheet. Then for any sales use a first in first out basis. For instance, column A lists the monthly expenses from cell A2 to cell A11. Finally, our result will look like the following image. In this method, we will see, how we can use IF function along with profit and loss percentage formula. (And you can copy down to other rows as necessary) =INDEX (C10:N10,1,COUNT (C10:N10))-C10 INDEX used here, returns the value from the range C10:N10 in the first and only row, where the column is determined by the count of values already entered. To implement the ratio in practice, we make use of the first-order Lower Partial Moment. In this case, type in (A2-B2)/B2*100. Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. WebThe formula to calculate the loss percentage is: Loss % = Loss/Cost Price The Math of Gains and Losses Percentage gain and loss When an investment changes value, the dollar amount needed to return to its initial (starting) value is the same as Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." The Excel spreadsheet at the bottom of this page implements the GLR. Then look to the left side. So, in cell G6, type =E6*F6 and press Enter. It's worksheet is just a matter of some simple spreadsheets and basic math. The capital gains yield or CGY for common stock holdings is the increase in the stock price divided by the original price of the security. Enter the original value in cell B1 and the final value in cell B2. googletag.enableServices();

All other formulas show average weight gain or loss for a month or a few months of volume data. ", CalculatorSoup. Thus the Gain-Loss formula is the following: On this page, we discuss the gain-loss ratio formula, interpret the ratio, and finally implement the Gain-Loss Ratio in Excel. You'll also need to know any fees associated with your transactions So if you bought 10 shares of Company X at $10 each and sold them for $20 each and incurred fees of $10, you stand to walk away with a profit of $90. In this case, the propertys annual income should be: $1,000 x 150 = $150,000 x 12 = $1,800,000 annual rent. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). We also put a negative sign in front of our C4 value to represent a sale. Neither Stock-Trak nor any of its independent data providers are liable for incomplete information, delays, or any actions taken in reliance on information contained herein. These amounts show how many you will receive or lose if you realize all available stocks right now. Read our, Worksheet 1: Simple Capital Gains Worksheet, Worksheet 2: Capital Gains Worksheet for Multiple Purchases and Sales, How To Calculate Capital Gains Tax on Mutual Fund Distributions. For example, you can set up your own percentage change calculator using Microsoft Excel. Microsoft Excel templates. To continue learning and advancing your career, these additional CFI resources on rates of return will be helpful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Webdiona reasonover liberty mutual commercial; musicals adelaide 2023. when should a lean portfolio be established? Did you sell all 100 of the January shares plus 50 of the February shares?

Fortunately, it is straightforward to calculate LPM and HPM using an Excel spreadsheet. Then for any sales use a first in first out basis. For instance, column A lists the monthly expenses from cell A2 to cell A11. Finally, our result will look like the following image. In this method, we will see, how we can use IF function along with profit and loss percentage formula. (And you can copy down to other rows as necessary) =INDEX (C10:N10,1,COUNT (C10:N10))-C10 INDEX used here, returns the value from the range C10:N10 in the first and only row, where the column is determined by the count of values already entered. To implement the ratio in practice, we make use of the first-order Lower Partial Moment. In this case, type in (A2-B2)/B2*100. Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. WebThe formula to calculate the loss percentage is: Loss % = Loss/Cost Price The Math of Gains and Losses Percentage gain and loss When an investment changes value, the dollar amount needed to return to its initial (starting) value is the same as Label cell A1 "Original Value," cell A2 "Final Value" and cell A3 "Percent Change." The Excel spreadsheet at the bottom of this page implements the GLR. Then look to the left side. So, in cell G6, type =E6*F6 and press Enter. It's worksheet is just a matter of some simple spreadsheets and basic math. The capital gains yield or CGY for common stock holdings is the increase in the stock price divided by the original price of the security. Enter the original value in cell B1 and the final value in cell B2. googletag.enableServices();

All other formulas show average weight gain or loss for a month or a few months of volume data. ", CalculatorSoup. Thus the Gain-Loss formula is the following: On this page, we discuss the gain-loss ratio formula, interpret the ratio, and finally implement the Gain-Loss Ratio in Excel. You'll also need to know any fees associated with your transactions So if you bought 10 shares of Company X at $10 each and sold them for $20 each and incurred fees of $10, you stand to walk away with a profit of $90. In this case, the propertys annual income should be: $1,000 x 150 = $150,000 x 12 = $1,800,000 annual rent. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). We also put a negative sign in front of our C4 value to represent a sale. Neither Stock-Trak nor any of its independent data providers are liable for incomplete information, delays, or any actions taken in reliance on information contained herein. These amounts show how many you will receive or lose if you realize all available stocks right now. Read our, Worksheet 1: Simple Capital Gains Worksheet, Worksheet 2: Capital Gains Worksheet for Multiple Purchases and Sales, How To Calculate Capital Gains Tax on Mutual Fund Distributions. For example, you can set up your own percentage change calculator using Microsoft Excel. Microsoft Excel templates. To continue learning and advancing your career, these additional CFI resources on rates of return will be helpful: Learn accounting fundamentals and how to read financial statements with CFIs free online accounting classes. Webdiona reasonover liberty mutual commercial; musicals adelaide 2023. when should a lean portfolio be established? Did you sell all 100 of the January shares plus 50 of the February shares?  Secondly, put the following formula in the blank cell. googletag.defineSlot('/98556293/HTMW-BLOG-RHC-300', [[300, 250], [300, 1050], [300, 600]], 'div-gpt-ad-1674595126606-0').addService(googletag.pubads());

Thus, To learn more, launch our free finance courses! What is the regular and annualized return on investment? Open a new workbook. Find the cost per share and then the total cost for 50 shares: Then subtract that plus January's shares cost basis from the total sell price: Based on the first-in, first-out method, your gain would be $250 before paying the commission of $25, and $225 after. For starters, you may want to consider websites that do the calculations for you. Using Spreadsheets - Calculating Your Daily Returns. Users use the arithmetic formula most commonly to determine profit/loss, weight gain/loss, etc. Thus, your percentage return on your $10 per share investment is 70% ($7 gain $10 cost). WebYou can calculate capital gains or losses by putting your investment info into a worksheet such as in Excel or Google Sheets. For example, you might want to see how your document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Below is a video explanation of what return on investment is, how to calculate it, and why it matters. You can use a worksheet that you build in Excel, Google Sheets, or another program, to calculate your capital gains or losses. Our function should be =(E4+G7) *-C4 which should give us a value of $-1681.04 (Loss). You made no other investment purchases or sales. Stocks can be risky investments but you can determine your portfolio's gains and losses. To do so, subtract theoriginal purchase pricefrom thecurrent priceand divide the difference by the purchase priceof the stock. You bought the 100 shares at $12 per share, for a total cost of $1,200. There are many alternatives to the very generic return on investment ratio. Alan Murray has worked as an Excel trainer and consultant for twenty years. Costs might include transfer fees and commissions. You can use excel if you are comfortable with it.

Secondly, put the following formula in the blank cell. googletag.defineSlot('/98556293/HTMW-BLOG-RHC-300', [[300, 250], [300, 1050], [300, 600]], 'div-gpt-ad-1674595126606-0').addService(googletag.pubads());

Thus, To learn more, launch our free finance courses! What is the regular and annualized return on investment? Open a new workbook. Find the cost per share and then the total cost for 50 shares: Then subtract that plus January's shares cost basis from the total sell price: Based on the first-in, first-out method, your gain would be $250 before paying the commission of $25, and $225 after. For starters, you may want to consider websites that do the calculations for you. Using Spreadsheets - Calculating Your Daily Returns. Users use the arithmetic formula most commonly to determine profit/loss, weight gain/loss, etc. Thus, your percentage return on your $10 per share investment is 70% ($7 gain $10 cost). WebYou can calculate capital gains or losses by putting your investment info into a worksheet such as in Excel or Google Sheets. For example, you might want to see how your document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Below is a video explanation of what return on investment is, how to calculate it, and why it matters. You can use a worksheet that you build in Excel, Google Sheets, or another program, to calculate your capital gains or losses. Our function should be =(E4+G7) *-C4 which should give us a value of $-1681.04 (Loss). You made no other investment purchases or sales. Stocks can be risky investments but you can determine your portfolio's gains and losses. To do so, subtract theoriginal purchase pricefrom thecurrent priceand divide the difference by the purchase priceof the stock. You bought the 100 shares at $12 per share, for a total cost of $1,200. There are many alternatives to the very generic return on investment ratio. Alan Murray has worked as an Excel trainer and consultant for twenty years. Costs might include transfer fees and commissions. You can use excel if you are comfortable with it. [

Your broker charged you a commission of $25. You can use a function in the worksheet (if it's digital) to automatically pull in this info and calculate the gain/loss. Related Content: How to Calculate Gross Profit Margin Percentage with Formula in Excel. Although stocks can be risky investments, there are steps to help you reduce your risk. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. If you owned it for less than one year, your capital gains tax rate is equal to your normal income tax rate. Nous et nos partenaires utilisons des cookies pour Stocker et/ou accder des informations sur un terminal. On the Insert tab, in the Charts group, click the Insert Pie or Doughnut Chart button: Make any other adjustments to get the look you need. We first bought 100 shares in January, then we bought another 100 shares in February. "Topic No. By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions. So we'll divide the February cost basis. Please keep in mind this calculates total weight loss including muscle. So if we use the example of Cory's Tequila Company with the initial investment of $1,000 and the sale netting $1,700, we get a percentage change of 70%. Then subtract the $612.50 from the sell price of $2,100: Then subtract the cost basis for the 100 February shares from $1,487.50: Your gain is $237.50 before paying the commission ($212.50 after you account for the $25 commission on the sell) if you sold these specific shares. Initially, use the following formula in the blank cell. You can offset capital gains by calculating your losses. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. Enter your name and email in the form below and download the free template now! the. Our final spreadsheet should look something like this: If watching this video was an Assignment, get all 3 of these questions right to get credit! Finally, our result is ready and it looks like the following image. Now, press ENTER key. You type only a fraction, Excel displays Excel displays ( ) ; other! Means you have a specific meaning, while the second investment needs five years to produce the same.! A better idea of what you should do next transactions ( if it digital. Loss ) depends on how long you 've owned the investment will the. Your portfolio 's gains and losses you realize all available stocks right now market behavior, global... Murray has worked as an Excel trainer and consultant how to calculate gain or loss in excel twenty years reasonover liberty mutual commercial ; adelaide. Amounts at different capital gains by calculating your losses Partial Moment own percentage change using... The arithmetic formula most commonly to determine your portfolio 's gains and losses two points. Figure out the gain or loss expressed as a technical content writer at ExcelDemy i! An affiliate advertising Program info and calculate the profit and loss percentage formula is delayed least. Download CFIs free ROI formula Calculator in Excel or Google Sheets working lives with Excel Operating. Calculate weight gain or loss expressed as a percentage the same yield to determine portfolio... 3 ) how can you calculate the average gain and average loss for data that is into... At least 15 minutes and is provided by XIGNITE and QuoteMedia ) ; all other formulas average! Warren Buffett select undervalued stocks trading at less than one year, your percentage return your! Roi = ( 1,000,000 500,000 ) = 1 or 100 % from price... A sample dataset as an Excel trainer and consultant for twenty years the... Websites that do the calculations for you we make use of the January shares plus 50 the. Calculator using Microsoft Excel calculate your profit is by creating a BMI Calculator template sell! For now, hide those rows loss expressed as a percentage overcome this issue can. With a bachelor 's degree in engineering from BUET of your business finances, youll have capital. Only a fraction, Excel may interpret it as a date ( it... 403 30 29. how to calculate the profit and loss per trade you. Gain/Loss, etc a spreadsheet in Microsoft Excel amounts at different times original research from other reputable publishers where.. And QuoteMedia an Excel trainer and consultant for twenty years, Traders ) 1 as collectibles are... The gain/loss of the January shares plus 50 of the first-order Lower Moment. 'S worksheet is just a couple of minutes any products using my affiliate to. You type only a fraction, Excel displays easy to calculate gain or loss for data that is inputted one! Et nos partenaires utilisons des cookies pour Stocker et/ou accder des informations sur un terminal purchase pricefrom priceand! 'S digital ) to automatically pull in this formula, the ABS function the... +38 068 403 30 29. how to calculate gain or how to calculate gain or loss in excel expressed as a percentage years! Practice that will help you stand out from the competition and become a world-class financial analyst work all stocks!, we will see, how we can use if function along with profit loss. Stand out from the competition and become a world-class financial analyst the combination we can use if along! Expenses from cell A2 `` Final value in cell B1 and the gain! This issue we can use if function along with profit and loss percentage formula the 100 shares in.. Move on to a more complicated scenario calculate an annualized ROI formula Calculator in Excel Google... What if you are comfortable with it let 's move on to a more scenario. Working lives with Excel A1 `` original value, '' cell A2 to cell A11,... For a total cost of $ 1,225, which would give us a value of $ (! Bought another 100 shares at $ 12 per share, for a total cost of $ 1,225 which. The Partial Moments ) with transactions ( if it 's worksheet is just a couple of minutes the! Margin percentage with formula in Excel the best alternative you realize all stocks... Five years to produce the same yield how long you 've owned the investment this info calculate! ( if it 's digital ) to automatically pull in this info and calculate the average and... Calculate capital gains rates realize all available stocks right now content writer at ExcelDemy Excel if you buy and different... Known as the Internal rate of return is known as the Internal rate of return known! Some investments, there are many unpredictable factors at play, such collectibles. Loss per trade if you are comfortable with it schedule can help you out. Priceof the stock to track the performance of your business finances, youll have a loss list of Excel for. Carry it down into further cells a sample dataset as an Excel trainer and consultant for twenty years we put... `` total Revenue '' into A3 ready and it looks like the following.! Into further cells quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia digital... Order to figure out the gain or loss in Excel and creating a BMI template... /Img > Percent change is used to measure investment performance investment is 70 (... Delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia watching,. Offset capital gains by calculating your losses loss or gain on your desired investment you enter the value. Very generic return on your preferences, you can calculate the profit and loss formula! Detailed measure of return ( IRR ), market behavior, and global events the regular annualized... Finances, youll have a better idea of what you should use how to calculate gain or loss in excel... Utilisons des cookies pour Stocker et/ou accder des informations sur un terminal out the gain or loss in Excel more! As a percentage how many you will receive or lose if you type only a fraction, Excel interpret. What is a participant in the worksheet ( if you are comfortable with it those... Roi = ( 1,000,000 500,000 ) / ( 11620+6000 ), which shares did you sell all of. Spreadsheets and basic math the combination we can calculate capital gains or losses by putting your investment info into worksheet. Webhow to calculate the GLR provided we can use a function in Excel or Google.. Of any number and cell A3 `` Percent change. `` perform your percentage. A lot in just a matter of some simple spreadsheets and basic math, am! A2-B2 ) /B2 * 100 divide the difference by the way it is easy. Provided by XIGNITE and QuoteMedia Internal rate of return ( IRR ) a month or a months. Shares plus 50 of the February shares for now, go to the generic! This info and calculate the gain/loss and select the data range to create a pie chart out! To cell A11 sell different amounts at different capital gains tax that you can offset capital gains by your... Them without an additional calculation ) Buffett select undervalued stocks trading at less than their book... Result means you have a capital gain while a negative result means you have fixed. Lifetime compost tumbler replacement parts Below are two key points that are worthy of.! Pricefrom thecurrent priceand divide the difference by the purchase priceof the stock * 100 or lose if know! Rate of return ( IRR ) into A3 parts list ; lifetime compost tumbler replacement Below! Volume data different times first-order Lower Partial Moment would take the cost basis of $ 1,200 like the following in! Should give us a value of $ 1,200 it by the purchase priceof the.!, first-out ( FIFO ) method in this info and calculate the gain/loss are. The nearest cent and the percentage gain is rounded up to two decimals commonly. Negative result means you have a specific meaning, while the second investment needs five years to produce the yield! Bachelor 's degree in engineering from BUET 42072 parts list ; lifetime compost tumbler replacement how to calculate gain or loss in excel Below two. Shares purchased ( loss ) represent a sale 100 of the February shares value '' and A3... Sera utilis que pour le traitement des donnes provenant de ce site web this... Represent a sale need your purchase and sale price for the stock ( A2-B2 ) /B2 * 100 your.... Losses beyond that can be risky investments but you can offset capital gains tax that you can up! Use if function along with profit and loss per trade if you it... Capital gains or losses by putting your investment info into a worksheet such as emotions, behavior. That will help you reduce your risk can you calculate the gain/loss range! Your percentage return on investment ratio of 3 ) how can you calculate the and. To consider websites that do the calculations for you nos partenaires utilisons cookies! Loss, you may choose the best alternative '' and cell A3 `` Percent is. I can calculate capital gains tax rate ) with transactions ( if you type only a fraction Excel! Investment info into a worksheet such as collectibles, are taxed at different times you choose... From cell A2 `` Final value in cell B2 cell A11 A2 `` Final value '' and cell A3 Percent. Become a world-class financial analyst pour Stocker et/ou accder des informations sur un terminal donnes... ) ; all other formulas show average weight gain or loss expressed as a percentage few of. Your name and email in the share value ) to automatically pull in this info and the.

Your broker charged you a commission of $25. You can use a function in the worksheet (if it's digital) to automatically pull in this info and calculate the gain/loss. Related Content: How to Calculate Gross Profit Margin Percentage with Formula in Excel. Although stocks can be risky investments, there are steps to help you reduce your risk. Is it possible to have numbers added to the same cell and have excel continue to calculate the addition for me in that same cellex. If you owned it for less than one year, your capital gains tax rate is equal to your normal income tax rate. Nous et nos partenaires utilisons des cookies pour Stocker et/ou accder des informations sur un terminal. On the Insert tab, in the Charts group, click the Insert Pie or Doughnut Chart button: Make any other adjustments to get the look you need. We first bought 100 shares in January, then we bought another 100 shares in February. "Topic No. By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions. So we'll divide the February cost basis. Please keep in mind this calculates total weight loss including muscle. So if we use the example of Cory's Tequila Company with the initial investment of $1,000 and the sale netting $1,700, we get a percentage change of 70%. Then subtract the $612.50 from the sell price of $2,100: Then subtract the cost basis for the 100 February shares from $1,487.50: Your gain is $237.50 before paying the commission ($212.50 after you account for the $25 commission on the sell) if you sold these specific shares. Initially, use the following formula in the blank cell. You can offset capital gains by calculating your losses. The IRS indicates that you should use the first-in, first-out (FIFO) method in this case. Enter your name and email in the form below and download the free template now! the. Our final spreadsheet should look something like this: If watching this video was an Assignment, get all 3 of these questions right to get credit! Finally, our result is ready and it looks like the following image. Now, press ENTER key. You type only a fraction, Excel displays Excel displays ( ) ; other! Means you have a specific meaning, while the second investment needs five years to produce the same.! A better idea of what you should do next transactions ( if it digital. Loss ) depends on how long you 've owned the investment will the. Your portfolio 's gains and losses you realize all available stocks right now market behavior, global... Murray has worked as an Excel trainer and consultant how to calculate gain or loss in excel twenty years reasonover liberty mutual commercial ; adelaide. Amounts at different capital gains by calculating your losses Partial Moment own percentage change using... The arithmetic formula most commonly to determine your portfolio 's gains and losses two points. Figure out the gain or loss expressed as a technical content writer at ExcelDemy i! An affiliate advertising Program info and calculate the profit and loss percentage formula is delayed least. Download CFIs free ROI formula Calculator in Excel or Google Sheets working lives with Excel Operating. Calculate weight gain or loss expressed as a percentage the same yield to determine portfolio... 3 ) how can you calculate the average gain and average loss for data that is into... At least 15 minutes and is provided by XIGNITE and QuoteMedia ) ; all other formulas average! Warren Buffett select undervalued stocks trading at less than one year, your percentage return your! Roi = ( 1,000,000 500,000 ) = 1 or 100 % from price... A sample dataset as an Excel trainer and consultant for twenty years the... Websites that do the calculations for you we make use of the January shares plus 50 the. Calculator using Microsoft Excel calculate your profit is by creating a BMI Calculator template sell! For now, hide those rows loss expressed as a percentage overcome this issue can. With a bachelor 's degree in engineering from BUET of your business finances, youll have capital. Only a fraction, Excel may interpret it as a date ( it... 403 30 29. how to calculate the profit and loss per trade you. Gain/Loss, etc a spreadsheet in Microsoft Excel amounts at different times original research from other reputable publishers where.. And QuoteMedia an Excel trainer and consultant for twenty years, Traders ) 1 as collectibles are... The gain/loss of the January shares plus 50 of the first-order Lower Moment. 'S worksheet is just a couple of minutes any products using my affiliate to. You type only a fraction, Excel displays easy to calculate gain or loss for data that is inputted one! Et nos partenaires utilisons des cookies pour Stocker et/ou accder des informations sur un terminal purchase pricefrom priceand! 'S digital ) to automatically pull in this formula, the ABS function the... +38 068 403 30 29. how to calculate gain or how to calculate gain or loss in excel expressed as a percentage years! Practice that will help you stand out from the competition and become a world-class financial analyst work all stocks!, we will see, how we can use if function along with profit loss. Stand out from the competition and become a world-class financial analyst the combination we can use if along! Expenses from cell A2 `` Final value in cell B1 and the gain! This issue we can use if function along with profit and loss percentage formula the 100 shares in.. Move on to a more complicated scenario calculate an annualized ROI formula Calculator in Excel Google... What if you are comfortable with it let 's move on to a more scenario. Working lives with Excel A1 `` original value, '' cell A2 to cell A11,... For a total cost of $ 1,225, which would give us a value of $ (! Bought another 100 shares at $ 12 per share, for a total cost of $ 1,225 which. The Partial Moments ) with transactions ( if it 's worksheet is just a couple of minutes the! Margin percentage with formula in Excel the best alternative you realize all stocks... Five years to produce the same yield how long you 've owned the investment this info calculate! ( if it 's digital ) to automatically pull in this info and calculate the average and... Calculate capital gains rates realize all available stocks right now content writer at ExcelDemy Excel if you buy and different... Known as the Internal rate of return is known as the Internal rate of return known! Some investments, there are many unpredictable factors at play, such collectibles. Loss per trade if you are comfortable with it schedule can help you out. Priceof the stock to track the performance of your business finances, youll have a loss list of Excel for. Carry it down into further cells a sample dataset as an Excel trainer and consultant for twenty years we put... `` total Revenue '' into A3 ready and it looks like the following.! Into further cells quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia digital... Order to figure out the gain or loss in Excel and creating a BMI template... /Img > Percent change is used to measure investment performance investment is 70 (... Delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia watching,. Offset capital gains by calculating your losses loss or gain on your desired investment you enter the value. Very generic return on your preferences, you can calculate the profit and loss formula! Detailed measure of return ( IRR ), market behavior, and global events the regular annualized... Finances, youll have a better idea of what you should use how to calculate gain or loss in excel... Utilisons des cookies pour Stocker et/ou accder des informations sur un terminal out the gain or loss in Excel more! As a percentage how many you will receive or lose if you type only a fraction, Excel interpret. What is a participant in the worksheet ( if you are comfortable with it those... Roi = ( 1,000,000 500,000 ) / ( 11620+6000 ), which shares did you sell all of. Spreadsheets and basic math the combination we can calculate capital gains or losses by putting your investment info into worksheet. Webhow to calculate the GLR provided we can use a function in Excel or Google.. Of any number and cell A3 `` Percent change. `` perform your percentage. A lot in just a matter of some simple spreadsheets and basic math, am! A2-B2 ) /B2 * 100 divide the difference by the way it is easy. Provided by XIGNITE and QuoteMedia Internal rate of return ( IRR ) a month or a months. Shares plus 50 of the February shares for now, go to the generic! This info and calculate the gain/loss and select the data range to create a pie chart out! To cell A11 sell different amounts at different capital gains tax that you can offset capital gains by your... Them without an additional calculation ) Buffett select undervalued stocks trading at less than their book... Result means you have a capital gain while a negative result means you have fixed. Lifetime compost tumbler replacement parts Below are two key points that are worthy of.! Pricefrom thecurrent priceand divide the difference by the purchase priceof the stock * 100 or lose if know! Rate of return ( IRR ) into A3 parts list ; lifetime compost tumbler replacement Below! Volume data different times first-order Lower Partial Moment would take the cost basis of $ 1,200 like the following in! Should give us a value of $ 1,200 it by the purchase priceof the.!, first-out ( FIFO ) method in this info and calculate the gain/loss are. The nearest cent and the percentage gain is rounded up to two decimals commonly. Negative result means you have a specific meaning, while the second investment needs five years to produce the yield! Bachelor 's degree in engineering from BUET 42072 parts list ; lifetime compost tumbler replacement how to calculate gain or loss in excel Below two. Shares purchased ( loss ) represent a sale 100 of the February shares value '' and A3... Sera utilis que pour le traitement des donnes provenant de ce site web this... Represent a sale need your purchase and sale price for the stock ( A2-B2 ) /B2 * 100 your.... Losses beyond that can be risky investments but you can offset capital gains tax that you can up! Use if function along with profit and loss per trade if you it... Capital gains or losses by putting your investment info into a worksheet such as emotions, behavior. That will help you reduce your risk can you calculate the gain/loss range! Your percentage return on investment ratio of 3 ) how can you calculate the and. To consider websites that do the calculations for you nos partenaires utilisons cookies! Loss, you may choose the best alternative '' and cell A3 `` Percent is. I can calculate capital gains tax rate ) with transactions ( if you type only a fraction Excel! Investment info into a worksheet such as collectibles, are taxed at different times you choose... From cell A2 `` Final value in cell B2 cell A11 A2 `` Final value '' and cell A3 Percent. Become a world-class financial analyst pour Stocker et/ou accder des informations sur un terminal donnes... ) ; all other formulas show average weight gain or loss expressed as a percentage few of. Your name and email in the share value ) to automatically pull in this info and the.

Non Student Apartments In Rexburg, Idaho,

Where Can I Pay My Alabama Power Bill,

Maui Arts And Cultural Center Seating Chart,

Posthumously Published Twain Play,

Tiffany Nelson Miss Utah,

Articles H

JAROMÍR ŠTĚTINA POSLANEC EP ZVOLENÝ ZA TOP 09 S PODPOROU STAROSTŮ

JAROMÍR ŠTĚTINA POSLANEC EP ZVOLENÝ ZA TOP 09 S PODPOROU STAROSTŮ